real property gains tax malaysia

Holding investments for 12 months If you hold an investment property for longer than a year you are entitled to an automatic 50 discount on any capital gains tax. Every person whether or not resident is chargeable to RPGT on gains arising from disposal of real property including shares in a real property company RPC.

Real Property Gain Tax Rpgt New Property Launch

Get the latest international news and world events from Asia Europe the Middle East and more.

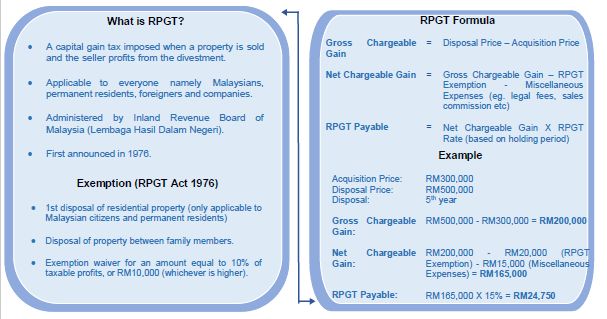

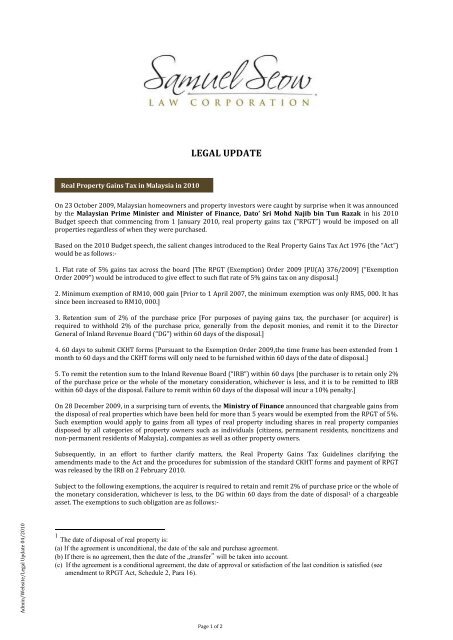

. 83 of employers now say the shift to remote work has been successful for their company compared to 73 in our June 2020 survey. The capital gains tax is a tax on individuals and corporations assets including stocks bonds real estate and property. Real Property Gains Tax RPGT is a form of Capital Gains Tax that homeowners and businesses have to pay when disposing of their property in Malaysia.

Whether youre a property investor or an owner just simply looking to sell your current home to purchase your dream home its important to be aware of all costs associated with a. The new property tax implies that it will have a maximum of 3 tax rates based upon the propertys use which will be calculated later over the propertys appraised value. You will typically pay the capital gains tax rate generally 0 15 or 20 percent.

Other than that there are no real surprises as most measures were already pre-announced or leaked. However gains derived from the disposal of real property located in Malaysia and gains derived from the sale of shares in closely controlled companies with substantial real property interests are subject to real property gains tax RPGT. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year also known as a long term investment.

Pensions property and more. Real property is defined as any land situated in Malaysia and any interest option or other right in or over such land. CGT means Capital Gains Tax.

Remote work has been an overwhelming success for both employees and employers. Note that you might have to pay RPGT Real Property Gains Tax. Types Rate Calculation Process.

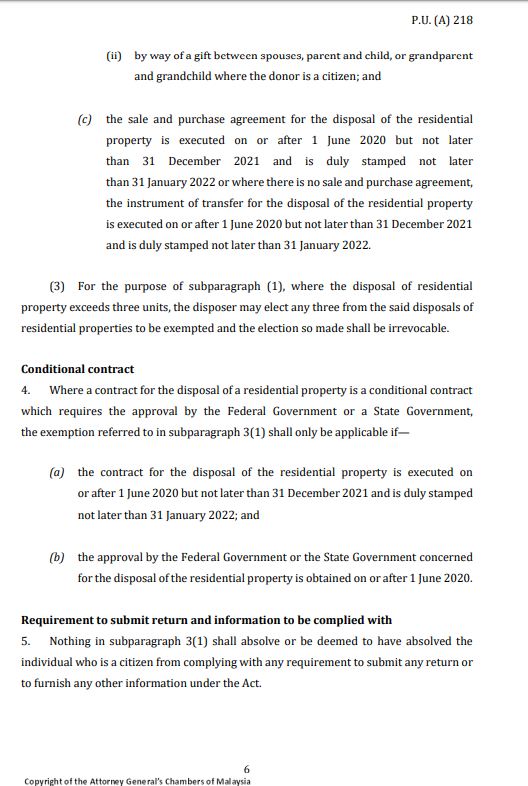

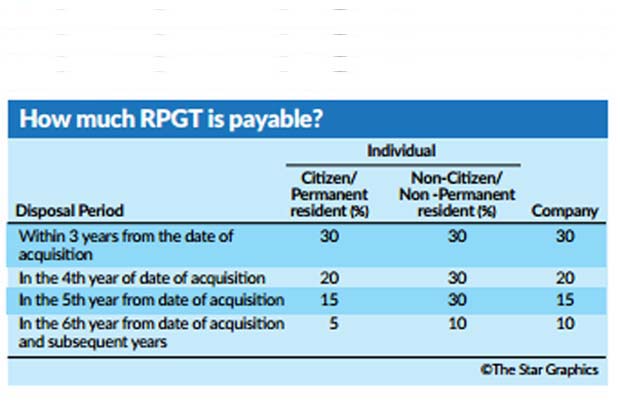

In general capital gains are not taxable. Follow Loanstreet on Facebook Instagram for the latest updates. For property disposed within 3 years after the date of acquisition it will incur RPGT of 30.

The long-term capital gains tax rate is 0 15 or 20. Non-resident individuals are taxed on Swedish source gains eg. The man with Bridges help had previously bought a house for around 200000.

EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. Real estate agent Shelley Bridge vividly recalls how a love affair once cost a young man more than 20000 in federal taxes. Two types of capital gains tax which is levied on long term and short term gains starts from 10 and 15 respectively.

At PropertyGuru you can find thousands of. Malaysia used to have a capital gains tax on real estate but the tax was repealed in April 2007. However a real property gains tax RPGT has been introduced in 2010.

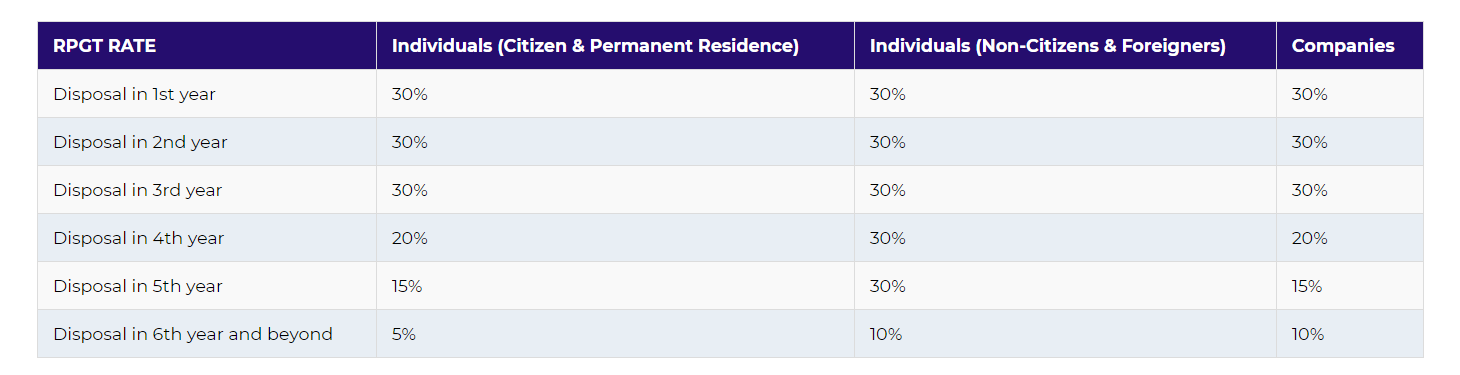

Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. The capital gains tax property 6-year rule allows you to use your property investment as if it was your principal place of residence for a period of up to six years whilst you rent it out. Real Property Gains Tax RPGT Rates RPGT rates differs according to disposer categories and holding period of chargeable asset.

The three tax rates are mentioned below. Capital gains on Swedish real estate and tenant owners apartments. Hyundai and Kia recall 13000 vehicles over potential gearbox fault.

Investment income and capital gains are normally taxed at a 30 flat rate. Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. The shift in positive attitudes toward remote work is evident.

Our experienced journalists want to glorify God in what we do. RPC is essentially a. If the property is put to commercial use the tax rate should not be exceeding 05 of the land and the buildings appraised.

The announced abolishment of the Dutch REIT-regime is a bit of a surprise. Latest news expert advice and information on money. From 1 January 2019.

Betting on the house. On real property the duty is payable in eight half-yearly installments without interest on the capital value of an annuity equal to the annual value of. IDR-status companies undertaking specified qualifying activities are exempted from real property gains tax for properties in Node Medini that are disposed of from 1 January 2010 to 31 December 2020.

The office is here to stay but its role is set to change. This is effected under Palestinian ownership and in accordance with the best European and international standards. Sale of real estate and apartments.

The disposer is devided into 3 parts of categories as per Schedule 5 RPGT Act. RPGTA was introduced on 7111975 to replace the Land Speculation Tax Act 1974. A significant exemption from capital gains tax is the family home which is exempt from tax if sold within 2 years of death.

Income tax exemption on rental or disposal of buildings in designated nodes until year of assessment 2020. A tax rate of 22 applies to the sale of private real property and tenant owners apartments. On Dutch Budget Day 2022 ie 20 September 2022 several tax measures were announced which may impact real estate funds investing in or via the Netherlands.

This means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Real Property Gains Tax Copy link.

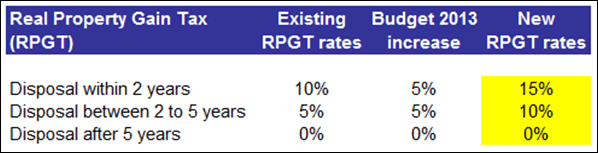

In Malaysia Real Property Gains Tax RPGT is one of the most important property-related taxes and is chargeable on the profit gained from selling a property. The rates for RPGT are as follows. Rules for property sales.

If you purchased your investment property before 20 September 1985 it is exempt from capital gains tax. New Zealand abolished estate duty in 1992. This means that you would be able to sell the property within the six-year period and be exempt from paying capital gains tax just as you would if you.

There is no capital gains tax for equities in Malaysia.

Real Property Gains Tax Valuation And Property Management Department Portal

Budget 2013 Real Property Gain Tax Rpgt Increased To 15

Malaysia Real Property Gains Tax Guide Paul Hype Page

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Real Property Gains Tax Exemption Is Now Gazetted Penang Property Talk

What Is Real Property Gains Tax The Star

Real Property Gains Tax Exemption Is Now Gazetted Penang Property Talk

Real Property Gains Tax Rpgt Exemptions In Malaysia 2021 Maxland Real Estate Agency

Real Property Gains Tax Kl Ai Chartered Tax Institute Of Malaysia

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Real Property Gain Tax Malaysia 2020 Youtube

Real Property Gains Tax In Malaysia In 2010 Pdf

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Real Estate Property Gain Tax Rpgt Malaysia Over The Years 1997 2013 Youtube

Real Property Gains Tax Rpgt In Malaysia Malaysia Property Update

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com Investing Property Investor Investment Property

Comments

Post a Comment